Secondly, if your home mortgage lending institution allows principal prepayments and credits them to your balance as they are made, and you can continue to make the original month-to-month payment amount, you would conserve more cash just prepaying your principal instead of doing an official recast. On the other hand, if you have a fully-funded emergency fund, no greater interest debt, and your lender won't credit primary prepayments as they are made, then modifying your home loan may be an excellent idea-- especially in cases where refinancing is either not a choice or does not provide any substantial savings.

Here are a couple of things to bear in mind if you're thinking about checking into a re-amortization to decrease your payment: Many lenders charge a cost for recasting ($ 150-$ 500) and most require a minimum primary payment ($ 1,000 - $10,000, or in many cases 10% of the balance owed). Not all home mortgages receive recasting.

Chase's site and/or mobile terms, privacy and security policies don't apply to the website or app you're about to visit. Please review its terms, privacy and security policies to see how they use to you. Chase isn't accountable for (and doesn't offer) any products, services or content at this third-party website or app, other than for services and products that clearly bring the Chase name.

The Ultimate Guide To School Lacks To http://edwinaptu754.cavandoragh.org/things-about-why-do-people-take-out-second-mortgages Teach Us How Taxes Bills And Mortgages Work

A home loan recast causes the loan to reamortize. Based upon your newly decreased loan balance, the lending institution will determine a brand-new monthly payment schedule. In almost all cases, you'll end up with a lower payment. You'll likewise pay less interest in time although your rate itself will not alter. Since modifying can require time to procedure, keep in mind to make your normal home loan payments up until the account shows the brand-new payment quantity.

But recasting a home loan in fact isn't the very same thing as making extra payments or prepayments on your loan. If you pay a swelling amount on your own without modifying, you have actually successfully decreased your home mortgage principal, but not your regular monthly payment. That's because when you make these extra payments, no amortization or restructuring of the loan takes place.

A home loan recast, on the other hand, will not reduce your term length, however it will reduce your regular monthly payments. The biggest takeaway when considering a recast home loan is that it will not lower your home loan rate or shorten the staying loan term. If you are aiming to pay off your mortgage quicker, you can still make larger payments to pay for the principal after the recast.

Some Known Factual Statements About Hawaii Reverse Mortgages When The Owner Dies

However if you want smaller month-to-month payments, a recast home loan could be ideal for you. Let's look at an example of just how much you 'd pay before and after home mortgage recasting. With a 30-year, fixed-rate home mortgage with a $400,000 principal quantity and 4. 5% rate of interest you would pay a $2,027 monthly payment.

With a recast you will be accountable for a $1,978 regular monthly payment for the staying 25 years of the term. (We got the figures utilizing our home mortgage calculator. Because a recast mortgage is just a reamortized loan, you can figure out your brand-new payments by inputting a new mortgage loan amount and altering the term.) A recast mortgage is a good concept only if you think the decrease in month-to-month payments is worth the swelling sum you paid up front.

You might even choose to see the cash grow. (Learn how to invest 100k). Everyone's financial scenario is various. At a look here are the benefits of modifying: Loan principal decrease Lower regular monthly payments Same rates of interest (great if it's low) Less overall interest paid And the drawbacks: Lower general liquidity Same rate of interest (bad if it's high) Exact same term length Charges If you're attempting to choose between recasting of refinancing your mortgage, you require to choose what your monetary goals are.

Get This Report about How Many Mortgages Can You Have With Freddie Mac

Recasting is simple, while re-financing provides customers a couple various choices about what occurs to their home loan. Re-financing a home loan takes place when you get a brand-new home mortgage to purchase out your old one. It's a common option primarily for borrowers seeking to lower rates of interest, reduce term lengths, or change other loan functions, like going from an adjustable-rate home mortgage to a fixed-rate one.

If your monetary standing has actually changed for example, if your credit rating plunged or your loan-to-value-ratio has gone up because you first took out the current home mortgage, then you may have trouble getting a bargain when refinancing. A home loan recast, on the other hand, doesn't need any monetary evaluation.

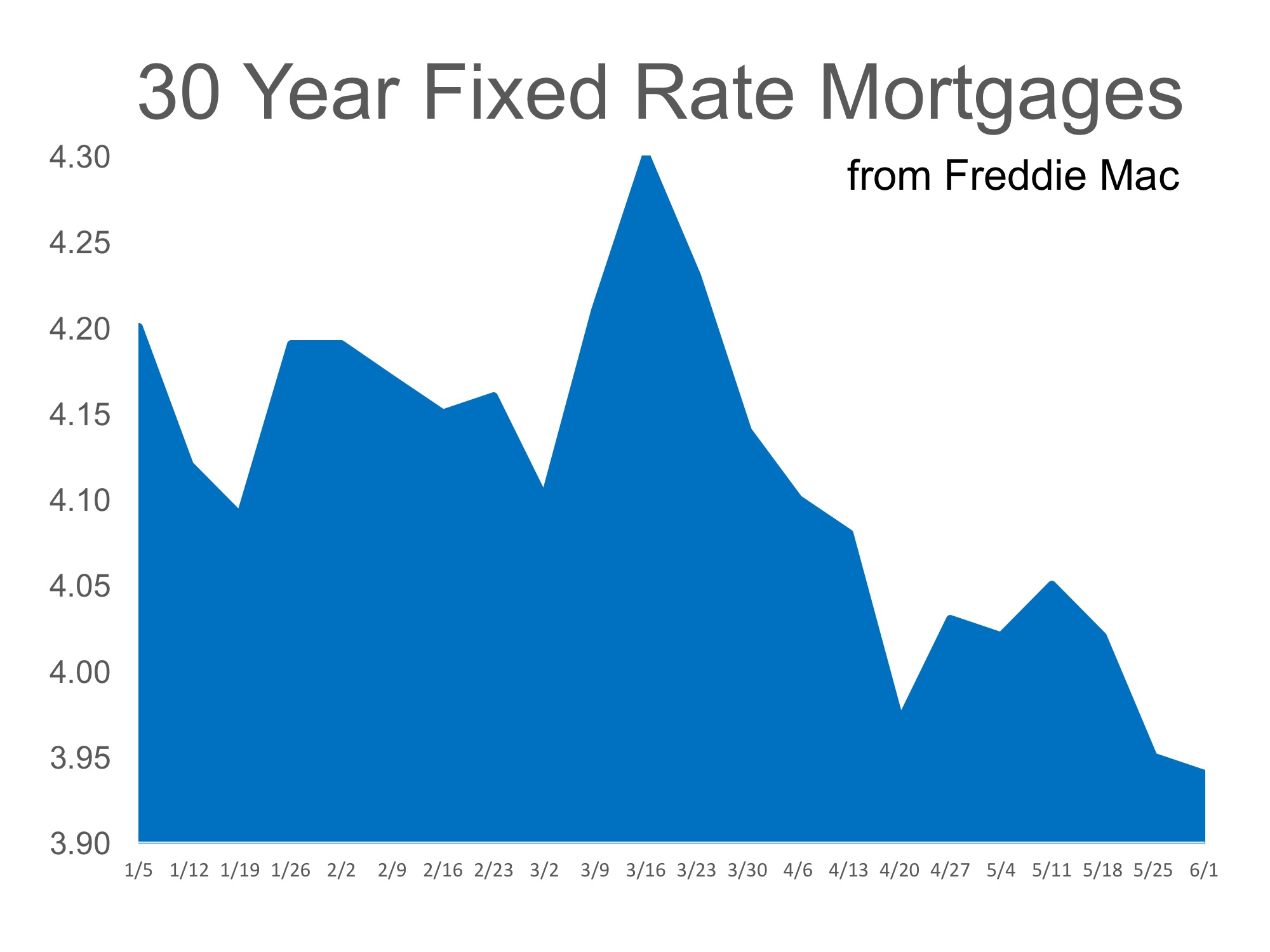

Nevertheless, when home loan rates are low, like they are now, refinancing can be worth it. (For instance, if you re-finance your home mortgage at a 3. 65% fixed rate for the $356,000 remaining loan balance in the above situation, your brand-new month-to-month payment would be $1,629 for 30 years.) Take a look at our weekly analysis of mortgage rates for more details.

How Is The Average Origination Fees On Long Term Mortgages Can Be Fun For Everyone

Note that neither modifying a home mortgage nor re-financing it would reduce other costs of homeownership, like real estate tax or homeowners insurance. (If your house owners insurance coverage rates have actually increased, you can try reshopping your policy. Policygenius can provide you quotes.) Home mortgage recastingMortgage refinancingLowers monthly paymentsCan lower monthly paymentsKeeps rate of interest the sameLowers interest rateKeeps term length the sameCan change term lengthCannot change loan typeCan transform loan typeNo credit checkCredit check and applicationLower costs that recoup easilyHigher charges (closing expenses).

There's a simpler and lesser-known choice than refinancing for property owners who wish to decrease their month-to-month mortgage payment - which mortgages have the hifhest right to payment'. It's cheaper, too. Rather of paying a few thousand dollars in refi costs, they can "modify" their existing loan for a couple of hundred dollars and still have a lower regular monthly payment, and their loan balance will be lower, too.

The rate of interest and loan term remain the exact same. Just the monthly payment is lowered due to the fact that the principal has actually been minimized. Recasts are normally done when someone comes into a large amount of money, such as an inheritance, pay benefit at work, or win the lottery. Borrowers should be current on their loan payments to receive a loan recast.

Excitement About There Are Homeless People Who Cant Pay There Mortgages

It's not a lot of cash, but with the rental hardly making cash, the $10,000 recast enabled him to be able to pay for and keep the home. "It gives me a little bit more wiggle space in the budget sheet," Nitzsche states. For homeowners with $10,000 or so to put toward their home mortgage, it might make more sense to put the cash toward the principal and not reduce their regular monthly payments so they can settle the loan much faster.

Nitzsche did a recast for a various reason. He doesn't intend on offering the home in a few years and doesn't wish to settle the loan balance. He was simply trying to find a more inexpensive loan without the expense of refinancing. He got a $10,000 HAMP, or House Affordable Modification Program, reward to assist him manage to keep the house after he was laid off from a previous task.

Recasts can be as low as $250 through a lending institution, though banks seldom market it and clients may need to ask if it's used. Fixed-rate loans are most likely to be recast than adjustable-rate loans. Recasts are generally allowed on traditional and conforming Fannie Mae and Freddie Mac loans, though not FHA and VA loans.